Smart Investing in Fintech: A Guide for Kenyan Investors

Kenyan fintech companies, including industry trailblazers like Safaricom, are reshaping the financial landscape. M-Pesa’s innovative solutions, such as Fuliza overdraft, have transformed access to financial services. For Kenyan investors, this presents a golden opportunity, but navigating risks is crucial for maximizing returns.

Juliana Rotich Joins Bill and Melinda Gates Foundation AI Ethics & Safety Committee

Discover the significant role played by Juliana Rotich, Head of Fintech Solution (M-Pesa) at Safaricom, on the Bill & Melinda Gates Foundation Board. With a focus on AI, Rotich aims to drive positive impact in global health and development. Her leadership underscores the foundation’s commitment to ethical AI investments and leveraging technology for the greater good.

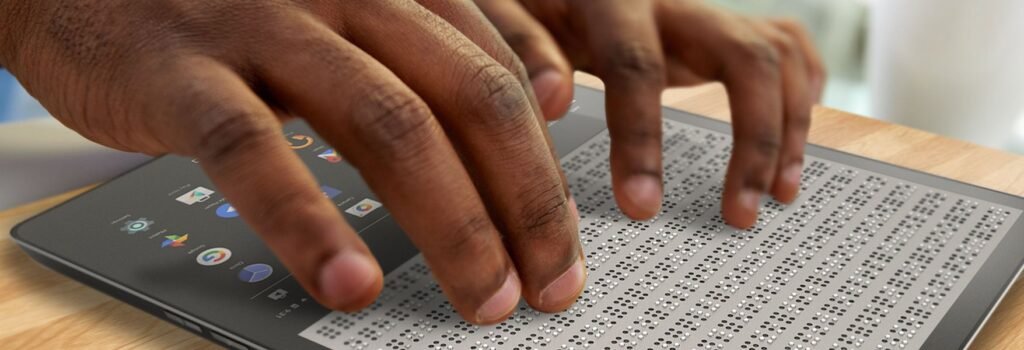

Fintech for all: Accessibility and inclusion

This article highlights the crucial role fintech platforms play in promoting financial inclusivity, particularly for persons with disabilities. By examining various solutions—from AI-driven accessibility features to P2P lending—it showcases how fintech is transforming finance, empowering individuals, and creating a more accessible and inclusive financial landscape.

Here are the latest funding news for startups in Africa, the US, the UK, and Australia.

Explore the surge in fintech investments globally, with companies like Zanifu, Koverly, Micronotes, Translucent, Maple, and Craftgate Technology securing significant funds for expanding operations and developing innovative financial solutions.”

Space Intelligence to Map Kenya and Tanzania for Carbon Markets

Space Intelligence, in partnership with Verra, is set to map Kenya and Tanzania for Verified Carbon Standard projects, revolutionizing the approach to baseline deforestation estimates. This innovative initiative utilizes AI technology and the consolidated REDD methodology to create precise maps of forest change. By centralizing the baseline creation process, Verra aims to bolster the integrity and transparency of carbon markets, redirecting climate finance to at-risk forests.

Why are Kenya’s financial institutions reluctant to embrace Cloud Computing?

Uncover the evolution of cloud computing from its early concepts to its current forms, emphasizing its benefits for financial institutions. Despite the advantages, challenges such as security, compliance, and data sovereignty persist. The article delves into the unique landscape of cloud computing in Kenya and South Africa, spotlighting key players and identifying factors influencing adoption. Discover the strategies cloud service providers can employ to encourage increased adoption in the evolving African tech landscape.

Airtel Africa and Mastercard Launch Cross-Border Remittance Service in 14 African Nations

Breaking borders, not wallets! Send & receive money across Africa instantly with Airtel & Mastercard’s revolutionary new remittance service. Connect to millions, drive financial inclusion, and experience a seamless digital future.

HOW TO PREPARE FOR THE WORSENING ECONOMIC TIMES.

In these uncertain times, many people are worried about the future of the economy. If you’re feeling unprepared, don’t panic! This guide offers practical steps you can take to weather any storm, including building a financial safety net, investing in passive income, and adopting a flexible lifestyle.

How to open a CDS account and invest in Treasury Bonds and Bills ONLINE – Step by Step Guide.

DhowCSD, the new platform for Kenyan investors, offers convenient mobile app and online registration for your CSD account. Explore the secondary market, invest in securities, and receive payments digitally. Experience faster setup, user-friendly interface, and efficient account management. Download the DhowCSD app or register online today!

How the Finance Bill 2023 Will Change How You Do Business in Kenya.

The Kenyan tax landscape is set for a major shift with the introduction of mandatory e-invoicing through the Finance Act 2023. This article delves into the implications of the new e-tims system for companies, individuals, and the Kenya Revenue Authority (KRA). It also highlights crucial aspects left unaddressed by the Act, potentially leading to confusion and compliance challenges.