Meta Spearheads the AI Revolution in Africa

In an era where artificial intelligence transforms how we interact with the web, Meta is leading the charge in Africa. The company’s groundbreaking AI newsreader marks a pivotal moment for the African digital landscape, highlighting the future of AI and presenting a golden opportunity for investors.

Demystifying Public Blockchains: Unveiling the Truth for Businesses

Discover the revolutionizing impact of blockchain on global industries and the common misconceptions hindering its adoption. This article delves into the intricacies of data security, dispelling myths around private and public blockchains. Uncover the fallacy of data concealment, the nuances between permissioned and permissionless blockchains, and the strength in numbers that makes public blockchains virtually hack-proof.

Mastercard Partners with Worldpay and Zip to Scale Open Banking Solutions

Mastercard is transforming the landscape of financial services by partnering with Worldpay and Zip to scale new open banking solutions. From simplifying bill payments to enhancing consumer lending processes and introducing advanced analytics, Mastercard’s initiatives are reshaping the future of payments. Dive into the details of how this collaboration is set to revolutionize financial experiences and provide more payment choices for consumers, businesses, and lenders.

Streamlining SACCO Operations Through Fintech Innovations

Uncover the dynamic shift in Kenyan SACCO operations as fintech platforms usher in a new era of efficiency, digital banking, and data-driven insights. Kwara, Wakandi, and M-Tawi stand at the forefront, redefining the landscape with innovative solutions.

Unlocking The Potential Of Blockchain In Africa

Delve into Africa’s fintech landscape and witness the transformative power of blockchain technology. From empowering the unbanked to revolutionizing land ownership and supply chains, blockchain is paving the way for economic growth and inclusivity. Despite challenges, Africa’s digital future shines brighter with blockchain at its core, unlocking vast potential and opportunities.

Juliana Rotich Joins Bill and Melinda Gates Foundation AI Ethics & Safety Committee

Discover the significant role played by Juliana Rotich, Head of Fintech Solution (M-Pesa) at Safaricom, on the Bill & Melinda Gates Foundation Board. With a focus on AI, Rotich aims to drive positive impact in global health and development. Her leadership underscores the foundation’s commitment to ethical AI investments and leveraging technology for the greater good.

Mobile money payments in Kenya grew by 6.3% in July, reaching a record high of Sh684.64 billion.

The Central Bank of Kenya’s recent approval of higher mobile money transaction limits is propelling the country’s financial landscape. Learn about the surge in mobile money accounts, active agents, and the CBK’s strategic move to deepen financial inclusion while addressing potential risks.

Lessons Kenya can learn from Egypt as inflation hits record high of nearly 40%

Egypt’s soaring inflation at 39.7% in August unveils critical economic lessons for Kenya. This analysis delves into the impact on currency value, food price hikes, and strategies to ensure economic stability in the face of challenges.

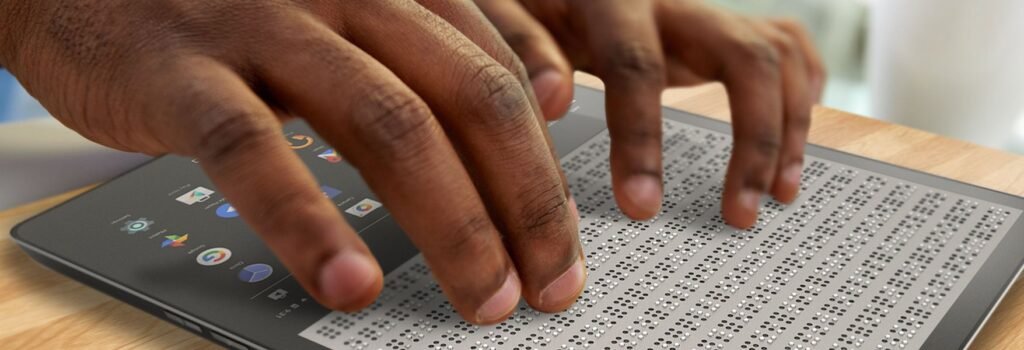

Fintech for all: Accessibility and inclusion

This article highlights the crucial role fintech platforms play in promoting financial inclusivity, particularly for persons with disabilities. By examining various solutions—from AI-driven accessibility features to P2P lending—it showcases how fintech is transforming finance, empowering individuals, and creating a more accessible and inclusive financial landscape.

Traditional meets Digital: The Role of Fintech in Preserving Kenya’s Financial Traditions.

This article delves into the symbiotic relationship between fintech platforms and Kenya’s financial traditions. From Chamas to loans and payments, fintech innovations seamlessly integrate with and respect established practices. Discover how platforms like M-pesa, Thunes, and Flutterwave digitize financial processes without compromising the essence of Kenya’s financial beliefs, offering a bright future while preserving tradition.