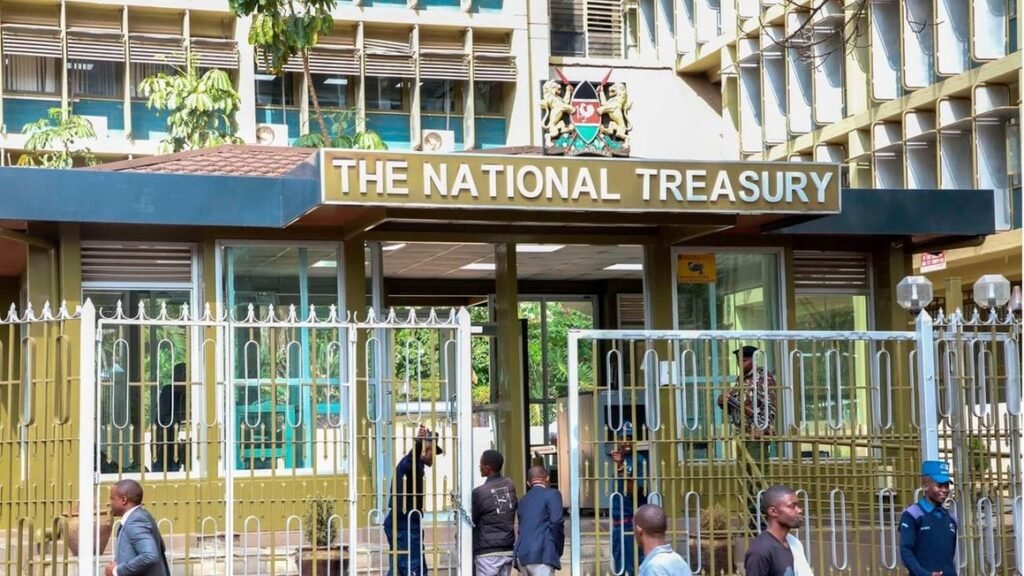

Unlocking Efficiency and Transparency: A Closer Look at Kenya’s Treasury Single Account (TSA)

Following the Cabinet’s approval of the Treasury Single Account (TSA) in January 2024, excitement has built around its potential to transform public finance management in Kenya. While acknowledging potential challenges, […]

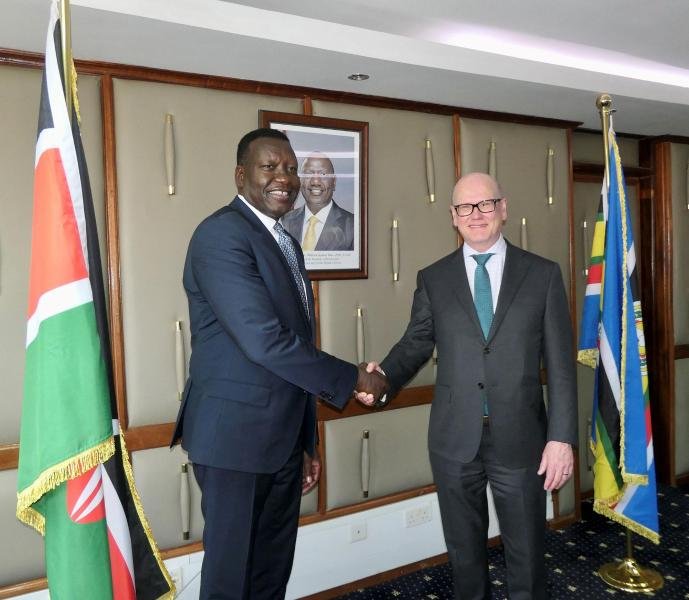

Nairobi Sees Major Boost in Climate Finance with EIB-CBK Partnership

Dive into the groundbreaking collaboration between the European Investment Bank (EIB) and the Central Bank of Kenya (CBK) as they join forces to elevate climate finance in Kenya. From incorporating climate risk into regulatory frameworks to developing a green taxonomy, this initiative sets a precedent for East Africa. Get insights into how this partnership is reshaping Kenya’s financial sector towards sustainability and contributing to global climate goals.

Kenya’s Financial Inclusion Mirage: Beyond the Hype of Mobile Money.

While Kenya’s mobile money revolution has granted access to financial services for over 75% of its population, a closer look reveals a gap between access and impact. The focus on digitizing money delivery, not the products themselves, results in a hollow form of inclusion. True financial inclusion goes beyond access; it entails active utilization of diverse financial tools. This article delves into the need for a collaborative effort to nurture genuine financial inclusion in Kenya, addressing the ‘digital divide’ and empowering individuals to build a better future.

Transforming the Loan App Victims Kenya Group: From Victims to Responsible Borrowers

Delve into the paradox of the ‘Loan App Victims Kenya’ Facebook group, where individuals grappling with debt have the potential to drive positive change. This essay uncovers the root causes of financial struggles, emphasizing the need to transition from victimhood to responsible borrowing. Explore a multi-faceted approach involving financial literacy workshops, peer support, and collaboration with lending platforms. Witness the group’s transformation into advocates for financial empowerment, fostering a community committed to responsible financial decisions and positive change.

Dhow CSD to Make Government Securities Accessible to All Kenyans

The launch of Dhow CSD marks a significant step towards democratizing government securities trading in Kenya. With a digitized registration process and accessibility for all, Kenyans can now easily lend money to the government, enjoying high-interest rates without intermediaries. Explore the potential impact on banks’ liquidity and the broader financial sector.

Mobile money payments in Kenya grew by 6.3% in July, reaching a record high of Sh684.64 billion.

The Central Bank of Kenya’s recent approval of higher mobile money transaction limits is propelling the country’s financial landscape. Learn about the surge in mobile money accounts, active agents, and the CBK’s strategic move to deepen financial inclusion while addressing potential risks.

Traditional meets Digital: The Role of Fintech in Preserving Kenya’s Financial Traditions.

This article delves into the symbiotic relationship between fintech platforms and Kenya’s financial traditions. From Chamas to loans and payments, fintech innovations seamlessly integrate with and respect established practices. Discover how platforms like M-pesa, Thunes, and Flutterwave digitize financial processes without compromising the essence of Kenya’s financial beliefs, offering a bright future while preserving tradition.