A Cautionary Tale of IMF Loans: Economic Entrapment and Sustainable Growth.

Kenya’s encounter with IMF loans in the 1990s serves as a stark reminder of the perils associated with external debt. This article unravels the story, shedding light on how the IMF’s conditionalities, such as the imposition of a value-added tax (VAT) on fuel, can lead to short-term fiscal boosts and long-term economic downturns. Examining the pitfalls of IMF-imposed SAPs, it urges developing nations to exercise caution and prioritize sustainable economic growth over quick fixes.

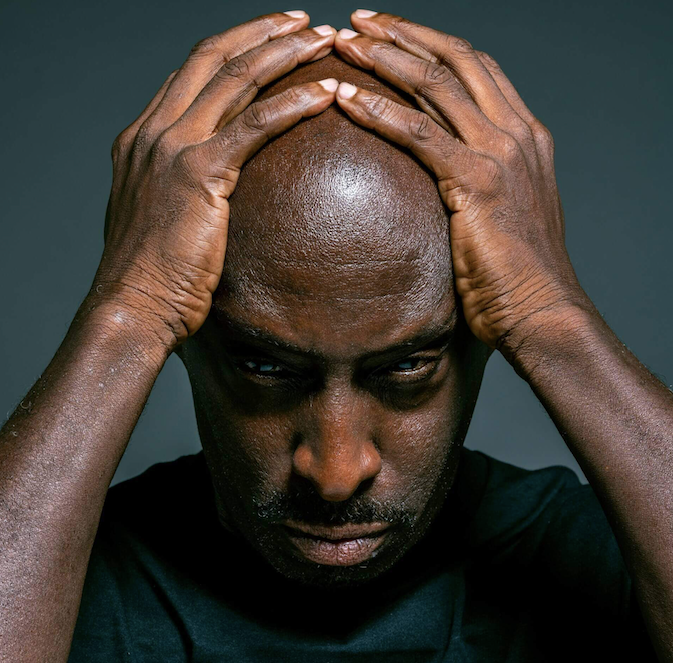

Black Tax Relief in Income Tax: A Necessary Step to Address Financial Hardship

The weight of black tax in Kenya affects individuals across economic backgrounds. From struggling families in rural areas to professionals who’ve served in international organizations, many face the challenge of supporting extended families. This article makes a compelling case for the Kenyan government to introduce income tax relief as a solution, discussing its potential to spur economic activity, reduce poverty, and enhance social cohesion.

Lessons Kenya can learn from Egypt as inflation hits record high of nearly 40%

Egypt’s soaring inflation at 39.7% in August unveils critical economic lessons for Kenya. This analysis delves into the impact on currency value, food price hikes, and strategies to ensure economic stability in the face of challenges.

Envisioning a Week Without M-Pesa.

A hypothetical week-long M-Pesa downtime could cause significant economic disruption and social inconvenience in Kenya, highlighting the critical role of M-Pesa in day-to-day transactions and the nation’s economy.

Digital lenders urged to increase credit access to the informal sector

Kenya’s vibrant Juakali sector awaits financial power! Experts urge mobile lenders to bridge the gap, with DLAK paving the way for responsible credit access and economic growth.