Africa’s Fintech Revolution: A Billion Dollar Venture Fueled by Innovation and Youth.

The African fintech industry stands at the cusp of a monumental shift, driven by a series of unique factors such as an exploding youth population, advancements in technology, and a […]

FIVE WAYS AI IS CHANGING LENDING FOR KENYAN BUSINESSES.

The advent of Artificial Intelligence has resulted in disruption of everyday activities. The banking and financial industry undergoes metamorphosis courtesy of this technology. As a result, Banks and Fintech organizations […]

ERIC MULI: The Man Behind Lipa Later That is Changing the Game in Africa.

You have probably walked into a store and spotted the perfect gadget that could change your life—that new laptop that you badly need for your side hustle, your dream phone, […]

Fintech Opportunities in DRC Congo: How Kenya Can Lead and Benefit.

The Democratic Republic of Congo (DRC), known for its natural resources, is now emerging as a promising player in the African Fintech landscape. Its recent membership in the East African […]

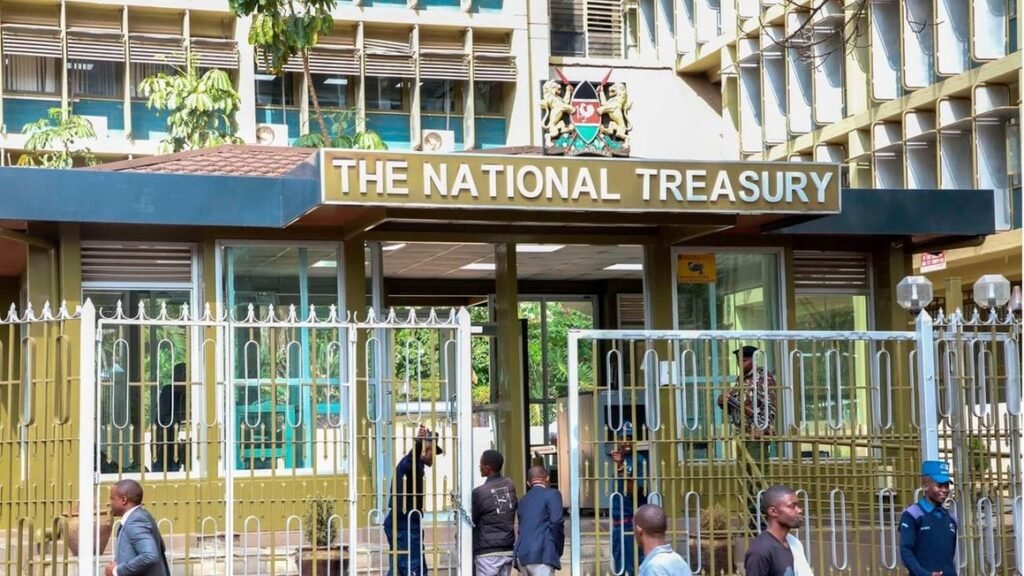

Unlocking Efficiency and Transparency: A Closer Look at Kenya’s Treasury Single Account (TSA)

Following the Cabinet’s approval of the Treasury Single Account (TSA) in January 2024, excitement has built around its potential to transform public finance management in Kenya. While acknowledging potential challenges, […]

Dr. Peter Munga: The Visionary Who Transformed Banking in Kenya and East Africa.

Discover the inspiring life of Peter Munga, born in 1943 in Nyagatugu village, who rose from humble beginnings to become the founder of Equity Bank. Munga’s journey from a provincial administration officer to a visionary entrepreneur is marked by resilience, determination, and a commitment to fighting poverty through financial empowerment. Learn how Equity Bank, under Munga’s leadership, evolved from a microfinance institution in Kangema to a cross-border corporate giant.

Kenya’s Financial Inclusion Mirage: Beyond the Hype of Mobile Money.

While Kenya’s mobile money revolution has granted access to financial services for over 75% of its population, a closer look reveals a gap between access and impact. The focus on digitizing money delivery, not the products themselves, results in a hollow form of inclusion. True financial inclusion goes beyond access; it entails active utilization of diverse financial tools. This article delves into the need for a collaborative effort to nurture genuine financial inclusion in Kenya, addressing the ‘digital divide’ and empowering individuals to build a better future.

Advocating for Regulatory Clarity in Motorcycle Financing

As Kenya’s bodaboda industry witnesses unprecedented growth, the spotlight is on microfinancing players who have played a pivotal role in this trajectory. With an impressive 90% of motorcycle sales financed by these players, they bridge the financial inclusion gap and assume substantial risks for the industry’s growth. However, recent regulatory discussions have highlighted gaps, urging a collaborative effort to address issues and provide clarity. This article emphasizes the critical need for an open forum to foster regulatory solutions, ensuring the continued prosperity of an industry that impacts millions of lives.

The Future of Banking in Kenya: Open, Flexible, and Customer-Centric.

Witness the banking revolution in Kenya as Banking as a Service (BaaS) and Open APIs redefine the financial landscape. From seamless integrations to personalized customer experiences, these technologies are propelling rapid innovation and expanding access to financial services. Learn how Kenyan fintech companies, including M-Pesa, Paystack, SasaPay, and Skaleet, are leveraging APIs and BaaS to create innovative solutions, paving the way for a customer-centric, open, and flexible future of banking in Kenya.

Flutterwave Gets International Remittance License in Malawi, to Power Remittances and Boost Economic Growth.

Flutterwave, Africa’s foremost payments technology company, expands its reach into Malawi with the acquisition of an IMTO license. This milestone not only empowers millions of Africans abroad but also contributes to economic growth, exchange rate stability, and infrastructure development in Malawi. Explore the benefits and commitment behind Flutterwave’s cross-border remittance solution, Send App, as it opens new possibilities for residents in Malawi.