Smart Investing in Fintech: A Guide for Kenyan Investors

Kenyan fintech companies, including industry trailblazers like Safaricom, are reshaping the financial landscape. M-Pesa’s innovative solutions, such as Fuliza overdraft, have transformed access to financial services. For Kenyan investors, this presents a golden opportunity, but navigating risks is crucial for maximizing returns.

Empowering African Founders: The Imperative of Homegrown Leadership in Africa’s Startup Ecosystem

Forget copycats, Africa needs innovators! While foreign investment fuels the continent’s startup surge, true progress lies in nurturing homegrown founders who understand Africa’s unique needs and drive its entrepreneurial future.

Partnerships, friendly policies are key to growing remittances

Sending money home to Africa just got easier! Dive into the strategies driving digital remittance adoption: streamlined regulations, cross-border partnerships & cost-cutting measures. See how Safaricom’s M-Pesa paves the way & empowers families across the continent.

Money Market Funds In Kenya and What To Consider Before Choosing One

Beat inflation & grow your wealth! Explore Kenyan Money Market Funds: Secure your short-term savings, earn juicy returns, & minimize risk. Compare leading funds like Cytonn, Zimele, & NCBA. Invest smarter, live richer!

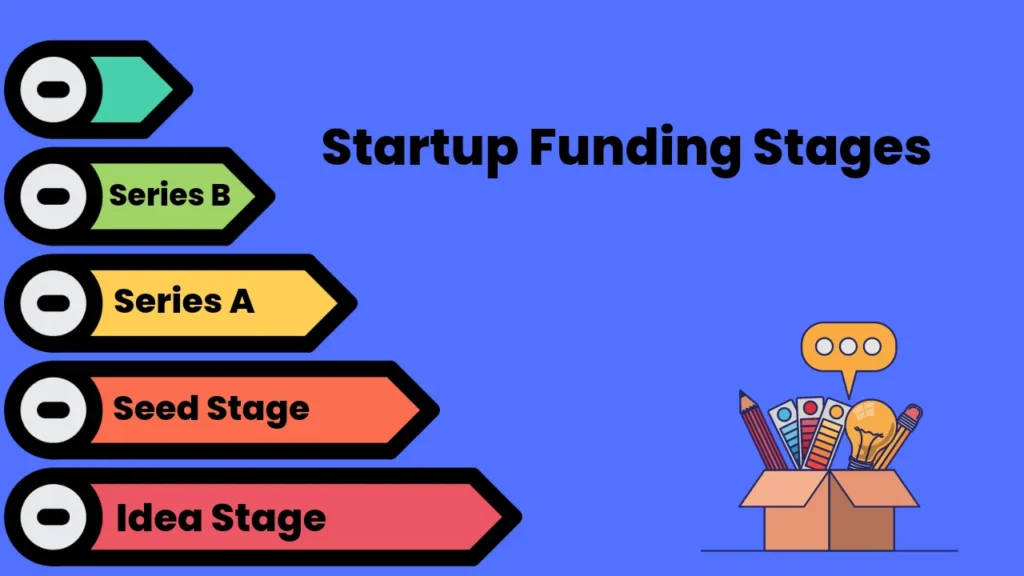

Why Venture-Backed Startups Are Losing Speed — and Creative Ways to Earn Funding in Challenging Economic Times

C drying up? Don’t sweat it! Explore these 5 unexpected funding lifelines: bootstrap like a boss, forge strategic alliances, tap government grants, ignite crowdfunding buzz, and embrace impact investing. Thrive, not just survive, in even the harshest economic climate.

Apple’s Success Is Making Things Tricky for Money Managers

Apple’s record size in the S&P 500 puts fund managers in a bind. Do they stick with the herd or diversify? Unpacking the “Apple Dilemma” and its impact on investors.

Kenya, the Silicon Valley of Africa

From M-Pesa’s groundbreaking mobile money to a thriving blockchain scene, Kenya has carved its niche as Africa’s innovation hub. A skilled workforce, favorable policies, and a strategic location are just a few reasons why global giants like Amazon and IBM choose Kenya for their African HQs. This excerpt delves into the factors fueling Kenya’s fintech revolution and why you should consider it for your next investment.