Building an Innovative Culture: A Blueprint for CEOs and Senior Leaders.

In today’s business landscape, the term “innovation” is constantly thrown around, but true innovation is not just a buzzword or a passing trend. It goes beyond implementing best practices and […]

Wash Wash 2.0: Even Wakanda Needs Protection.

Let’s face it. Cyber scams are not a question of “if”, rather than “when”. I bet you’ve heard or come across ‘Silicon Savannah’ somewhere. That’s Kenya, a country flourishing with […]

Gone But Not Forgotten: Recalling Kenya’s Era of Bold Ambition

Join us in a nostalgic journey through Kenya’s vibrant past, where the years between 2000 and 2010 were characterized by monumental growth and larger-than-life achievements. From visionary CEOs like Titus Naikuni and Martin Oduor to iconic media personalities such as Louis Otieno and Julie Gichuru, the era was marked by unprecedented success and influence across various sectors. However, as we reflect on these glory days, we also recognize the need to chart a new course for our nation’s future. It’s time to harness the lessons of the past and reignite the spirit of innovation and progress that defined Kenya’s golden era. Join the conversation and be part of shaping a brighter tomorrow for all.

Should Africa Nations Sacrifice Fossil Fuels for Climate Change?

Unravel the complexities of economic development and environmental stewardship in the context of hydrocarbon exploration. This article delves into the practical and economic concerns faced by African nations, emphasizing the need for a balanced approach to combat climate change without compromising economic stability. Is the expectation for climate action disproportionately affecting economically disadvantaged countries? Find out more about the growing discourse and the call for compensations in this exploration.

Common Traits Shared by Fraudsters and Fraud Attacks

Conquering Fraud in Kenya: From Impersonation to Clicks, Safeguard Your Digital Landscape

Impersonation, Dark Web schemes, click fraud, money laundering: the Kenyan digital landscape is rife with evolving threats. This guide equips individuals and businesses with the knowledge and strategies to combat these online dangers.

Unmasking Impersonation: Learn how fraudsters steal identities and manipulate payment details to trick you. Discover key strategies to protect your Mpesa transactions and personal information.

Navigating the Dark Web: Delve into the hidden corners of the Dark Web, where cybercriminals plot and trade stolen data. Uncover how staying informed about these platforms can help you stay ahead of the curve.

Cracking Fraud Rings: These coordinated scams thrive on anonymity. We reveal the art of “linking” seemingly disparate accounts to expose elaborate fraud networks.

Click Fraud: The Invisible Enemy: Understand how fake clicks drain advertising budgets and erode trust. Learn how to detect and protect yourself from this sophisticated online scam.

Money Laundering: Dirty Money in the Fintech Era: With Mpesa integration and cryptocurrency on the rise, money laundering concerns intensify. We explore identity verification techniques and strategies to combat this financial crime.

This comprehensive guide is your roadmap to online security in Kenya. Stay informed, stay vigilant, and safeguard your digital transactions from the evolving world of fraud.

Don’t let fraudsters win. Take control of your digital safety today!

Kenya’s Financial Inclusion Mirage: Beyond the Hype of Mobile Money.

While Kenya’s mobile money revolution has granted access to financial services for over 75% of its population, a closer look reveals a gap between access and impact. The focus on digitizing money delivery, not the products themselves, results in a hollow form of inclusion. True financial inclusion goes beyond access; it entails active utilization of diverse financial tools. This article delves into the need for a collaborative effort to nurture genuine financial inclusion in Kenya, addressing the ‘digital divide’ and empowering individuals to build a better future.

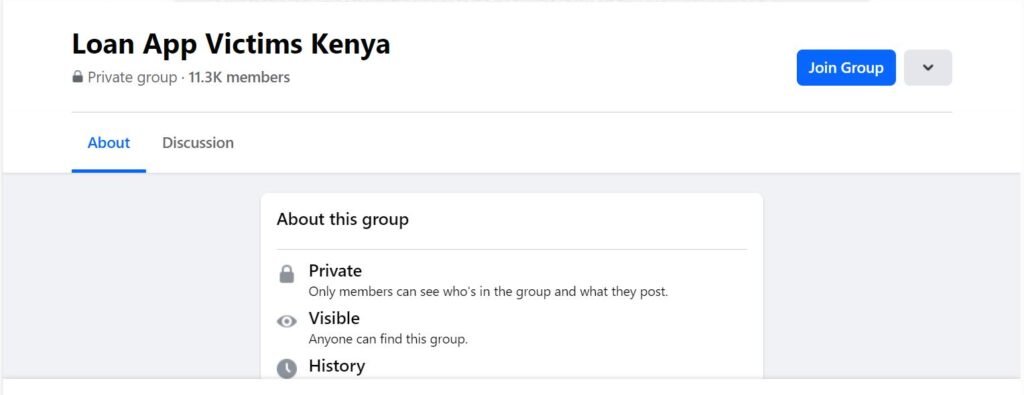

Transforming the Loan App Victims Kenya Group: From Victims to Responsible Borrowers

Delve into the paradox of the ‘Loan App Victims Kenya’ Facebook group, where individuals grappling with debt have the potential to drive positive change. This essay uncovers the root causes of financial struggles, emphasizing the need to transition from victimhood to responsible borrowing. Explore a multi-faceted approach involving financial literacy workshops, peer support, and collaboration with lending platforms. Witness the group’s transformation into advocates for financial empowerment, fostering a community committed to responsible financial decisions and positive change.

Advocating for Regulatory Clarity in Motorcycle Financing

As Kenya’s bodaboda industry witnesses unprecedented growth, the spotlight is on microfinancing players who have played a pivotal role in this trajectory. With an impressive 90% of motorcycle sales financed by these players, they bridge the financial inclusion gap and assume substantial risks for the industry’s growth. However, recent regulatory discussions have highlighted gaps, urging a collaborative effort to address issues and provide clarity. This article emphasizes the critical need for an open forum to foster regulatory solutions, ensuring the continued prosperity of an industry that impacts millions of lives.

The Lehman Bankruptcy and the Birth of Modern FinTech.

Dive into Numerix’s remarkable journey post-Lehman Brothers collapse, where visionary leadership and transformative innovations reshaped risk management. Discover how Steve O’Hanlon’s strategic shift propelled Numerix into a front-to-risk enterprise systems leader, showcasing the profound impact of FinTech evolution in the aftermath of the 2008 financial crisis.

A Cautionary Tale of IMF Loans: Economic Entrapment and Sustainable Growth.

Kenya’s encounter with IMF loans in the 1990s serves as a stark reminder of the perils associated with external debt. This article unravels the story, shedding light on how the IMF’s conditionalities, such as the imposition of a value-added tax (VAT) on fuel, can lead to short-term fiscal boosts and long-term economic downturns. Examining the pitfalls of IMF-imposed SAPs, it urges developing nations to exercise caution and prioritize sustainable economic growth over quick fixes.