Risk Management Experts Gather in Nairobi to Tackle Financial and Climate Challenges

Over 70 risk management professionals from diverse sectors convened at Equity Bank Headquarters in Nairobi on April 12 for the inaugural meeting of the Global Association of Risk Professionals (GARP) […]

Flutterwave Tops Fast Company’s List of Most Innovative Companies in Europe, Middle East, and Africa.

African fintech leader Flutterwave takes the #1 spot for innovation. Their solutions are transforming payments for businesses and individuals across Africa.

Digital Banking Risks: A CEO’s Guide to Protecting Your Business.

The rise of digital banking has transformed the financial landscape, but this convenience exposes financial institutions to evolving cybersecurity threats. Understanding these threats is vital for protecting your business and […]

Banking as a Service (BaaS) and Open APIs: The Future of Banking in Kenya.

Banking as a Service (BaaS) and Open APIs are revolutionizing the financial landscape. These technologies are not mere buzzwords; they represent a fundamental shift in how banks operate and customers […]

FIVE WAYS AI IS CHANGING LENDING FOR KENYAN BUSINESSES.

The advent of Artificial Intelligence has resulted in disruption of everyday activities. The banking and financial industry undergoes metamorphosis courtesy of this technology. As a result, Banks and Fintech organizations […]

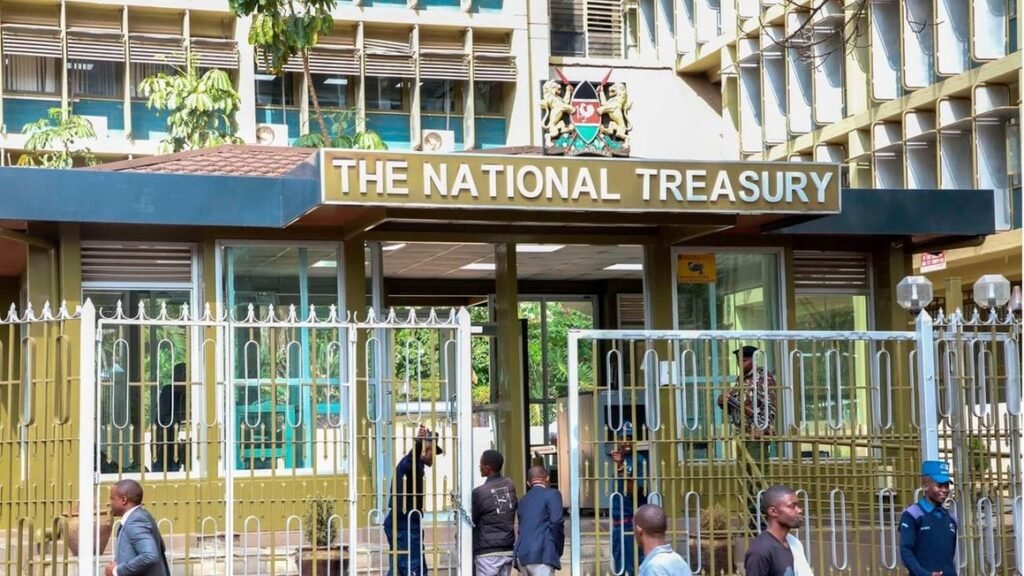

Unlocking Efficiency and Transparency: A Closer Look at Kenya’s Treasury Single Account (TSA)

Following the Cabinet’s approval of the Treasury Single Account (TSA) in January 2024, excitement has built around its potential to transform public finance management in Kenya. While acknowledging potential challenges, […]

Dr. Peter Munga: The Visionary Who Transformed Banking in Kenya and East Africa.

Discover the inspiring life of Peter Munga, born in 1943 in Nyagatugu village, who rose from humble beginnings to become the founder of Equity Bank. Munga’s journey from a provincial administration officer to a visionary entrepreneur is marked by resilience, determination, and a commitment to fighting poverty through financial empowerment. Learn how Equity Bank, under Munga’s leadership, evolved from a microfinance institution in Kangema to a cross-border corporate giant.

Dr. James Mwangi: The Maverick Banker, the Philanthropist, the Enigma.

James Mwangi is a Kenyan businessman and philanthropist who needs no introduction in his home country. He is widely recognized as the Group Managing Director and Group CEO of Equity […]

From Near Collapse to Billion-Dollar Success: Dr. Muriuki’s Co-op Bank Turnaround Story.

Discover the inspiring story of Dr. Gideon Muriuki, the visionary leader behind the Co-operative Bank’s remarkable turnaround. From navigating financial challenges to earning prestigious awards, delve into his transformative impact on the banking industry.

New Year’s Resolution: Time to Evaluate Your Legacy Systems

In the dynamic African financial landscape, legacy systems hinder growth. Explore the risks of clinging to outdated infrastructures, from lost market opportunities to hidden costs. Learn why 2024 is the ideal time for African banks to embark on a strategic journey of modernization, ensuring competitiveness, responsiveness, and compliance with platforms like Skaleet.