Kenya’s Financial Inclusion Mirage: Beyond the Hype of Mobile Money.

While Kenya’s mobile money revolution has granted access to financial services for over 75% of its population, a closer look reveals a gap between access and impact. The focus on digitizing money delivery, not the products themselves, results in a hollow form of inclusion. True financial inclusion goes beyond access; it entails active utilization of diverse financial tools. This article delves into the need for a collaborative effort to nurture genuine financial inclusion in Kenya, addressing the ‘digital divide’ and empowering individuals to build a better future.

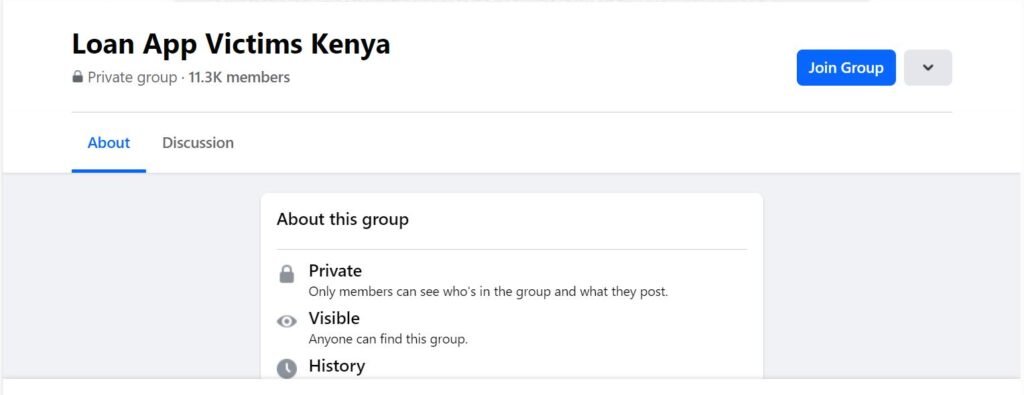

Transforming the Loan App Victims Kenya Group: From Victims to Responsible Borrowers

Delve into the paradox of the ‘Loan App Victims Kenya’ Facebook group, where individuals grappling with debt have the potential to drive positive change. This essay uncovers the root causes of financial struggles, emphasizing the need to transition from victimhood to responsible borrowing. Explore a multi-faceted approach involving financial literacy workshops, peer support, and collaboration with lending platforms. Witness the group’s transformation into advocates for financial empowerment, fostering a community committed to responsible financial decisions and positive change.